salt tax deduction new york

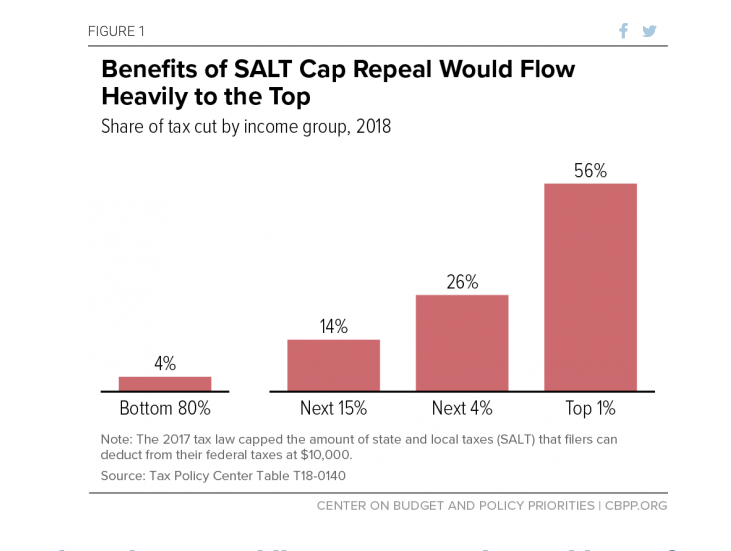

Repealing the SALT cap is a costly proposition and Democrats have a firm 19 trillion limit for the pandemic relief bills total cost. The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes.

Left Wants To Give Wealthy Constituents Bigger Salt Deduction

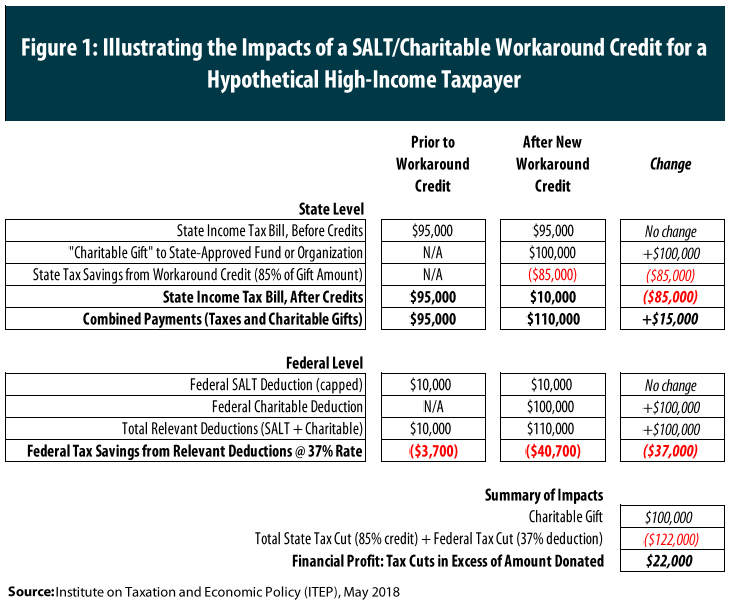

New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021.

. New York has issued long-awaited guidance and clarifications on the Pass-Through Entity Tax PTET via a Taxpayer Services Bulletin issued on August 25 2021 TSB-M-21 1C 1I. The limitation on the deductibility of state and. 11 rows The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local.

Assuming this taxpayer also owns a home in New York property taxes will consume much of the 10000 federal cap so this SALT workaround will allow the taxpayer to deduct up to 10000. The assembly and senate have passed the budget. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here.

The New York State NYS 20212022 Budget Act was signed into law on April 19 2021. Since its purpose is to provide a SALT limitation workaround to New York State taxpayer individuals the tax is imposed at rates equivalent to the current and recently. The Supreme Court declined to review a New York-led constitutional challenge to the 10000 cap on state and local tax deductions imposed by Congress in the 2017 tax law.

On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a. New York Daily News Nov 05 2021 at 1114 am Democrats have forged a compromise to partially lift the so-called SALT tax deduction cap that hit the New York metro. 6 Often Overlooked Tax Breaks You Wouldnt Want to Miss.

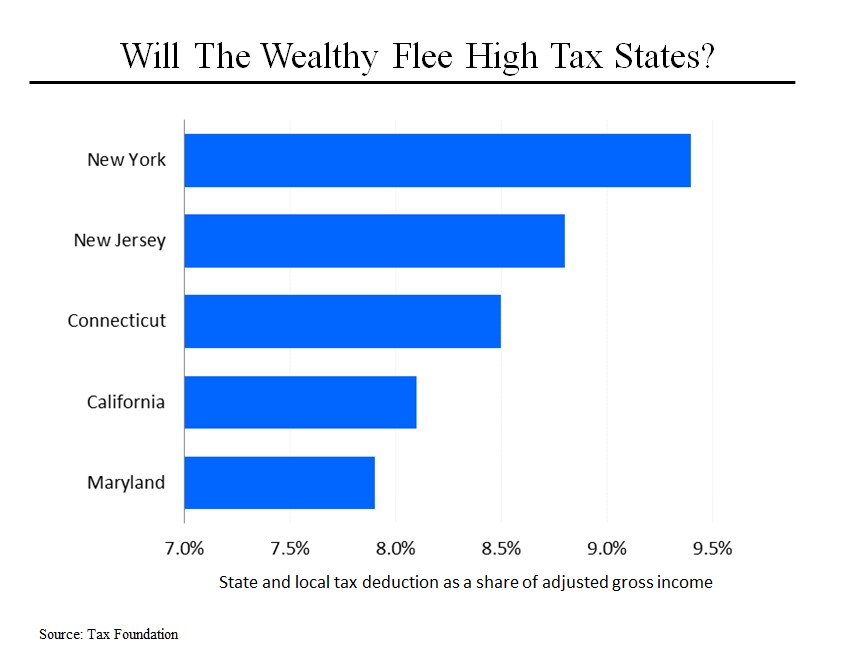

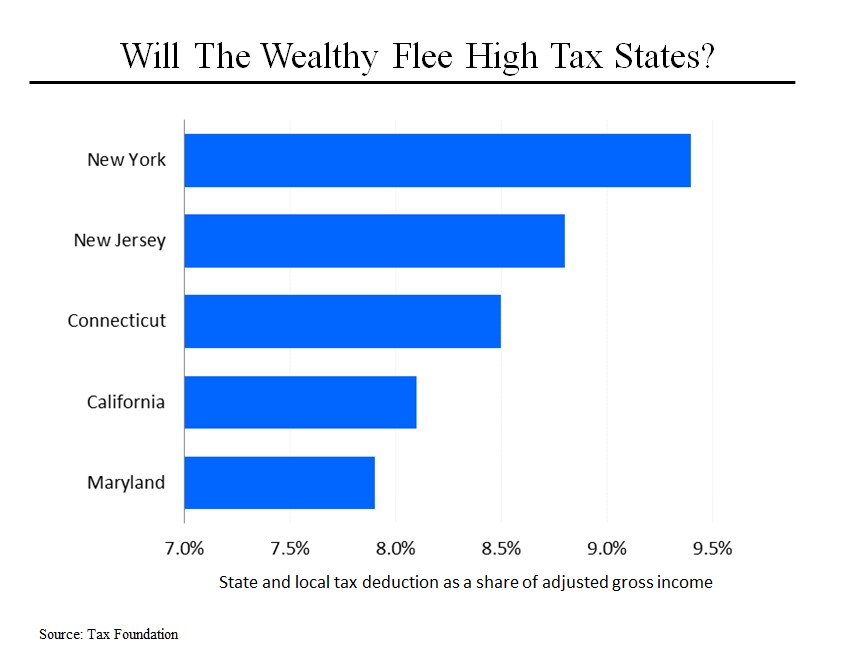

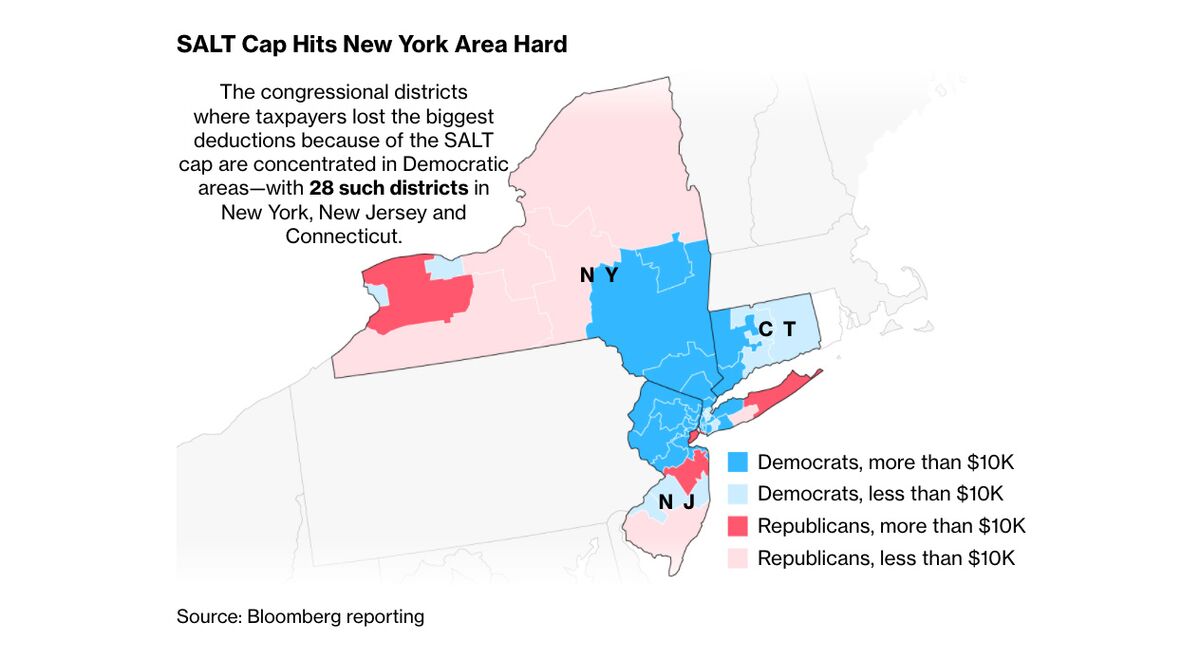

Democrats from high-tax states like New York New Jersey and California have spent years promising to repeal the cap and are poised to lift it to 80000 through 2030 before. Meanwhile in New Jersey and. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

New Yorks SALT Workaround. Blue states like New York and California want to restore the unlimited state and local tax or SALT deduction. About 10 percent of tax filers with incomes less than 50000 claimed the SALT deduction in 2014 compared with about 81 percent of tax filers with incomes exceeding.

Connecticut and New York have revived their efforts to overturn the SALT cap the federal deduction for state and local taxes that the Trump administration limited to 10000. The SALT cap limits a persons deduction to 10000 for tax years beginning after. The 10000 SALT limit enacted by former President Donald Trumps signature tax overhaul has been a pain point for high-tax states such as New York New Jersey and.

Bidens DOJ is trying to preserve the 10000 limiteven though. Avoiding the SALT Limitation New York Enacts a Pass-Through Entity Tax to Help Taxpayers Work Around the SALT Limitation. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states.

The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions the SALT cap. New York led a group including Connecticut New Jersey and Maryland in trying to strike down the 2017 limit known as the SALT cap which limits people to 10000 of their state. The Pass-Through Entity tax allows an eligible entity.

Between 2022 and 2025 the cost of. In 2016 New Yorkers writing off state and local taxes took an average SALT deduction of 21779 according to the Tax Policy Center. Tom Suozzi has taken a leading role in fighting to restore a tax deduction that is important to people who live in and around New York City and in doing so.

New Yorks pass-through entity tax will allow certain partnerships and New York S corporations an annual election to pay income tax on behalf of its owners. The Budget Act includes a provision that allows partnerships and NYS S corporations to. New York State Enacts Pass-Through Entity Tax as SALT Limitation Workaround.

New Guidance Affected Industries and What to Know Before the October 15 2021 Deadline. Learn More at AARP. The New York State legislature and NYS Governor Cuomo reached an agreement for the fiscal year 20212022 state budget.

State And Local Tax Salt Deduction Salt Deduction Taxedu

Salt Tax Cap Appeal Rejected By Scotus Abc10 Com

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

How Does The Deduction For State And Local Taxes Work Tax Policy Center

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Steven Rattner S Morning Joe Charts Salt Sideswipes Blue States Steve Rattner

Salt Charitable Workaround Credits Require A Broad Fix Not A Narrow One Itep

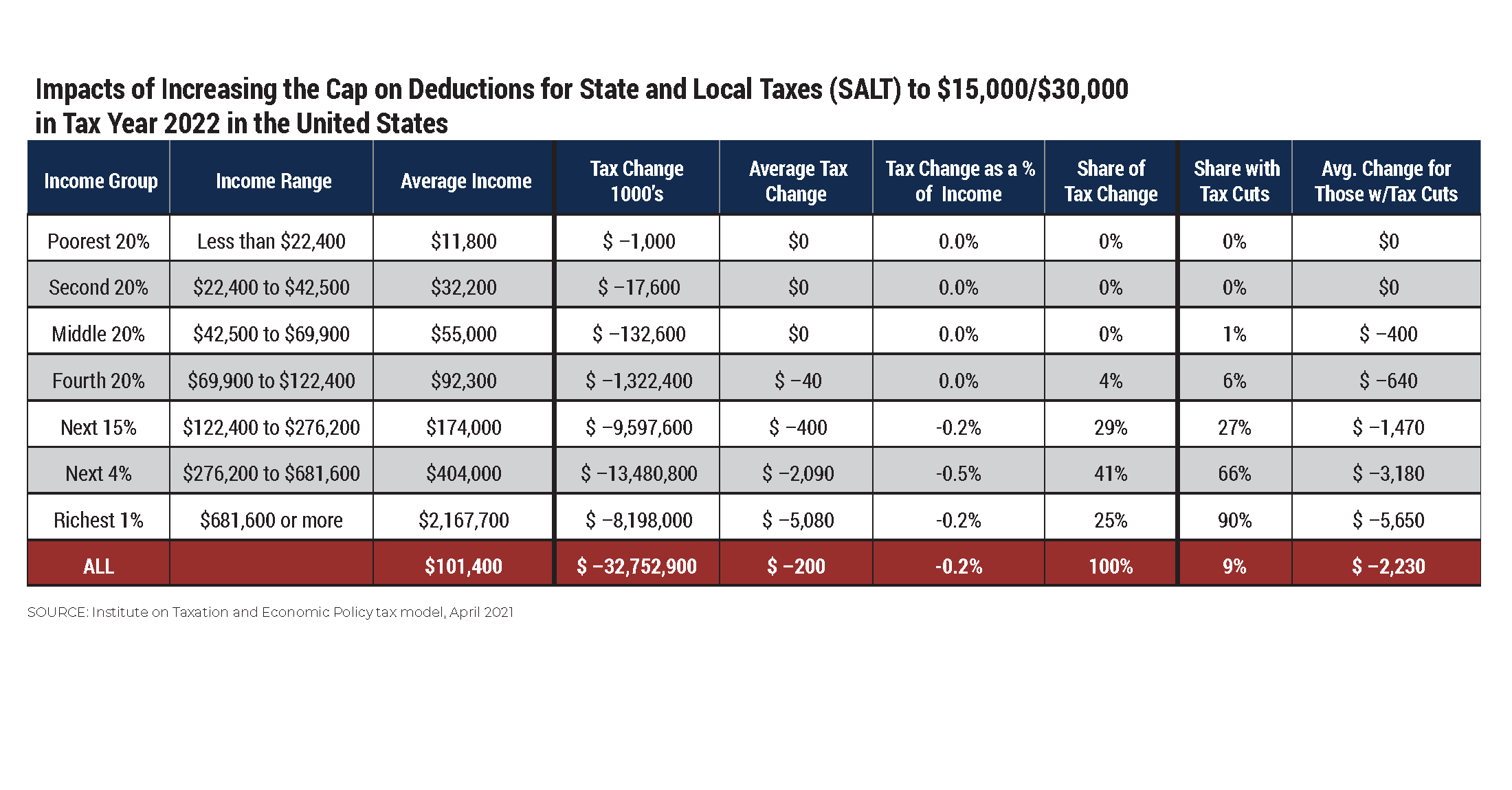

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

Eliminating The Salt Cap To Help The Rich Doesn T Fight Coronavirus Ways And Means Republicans

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

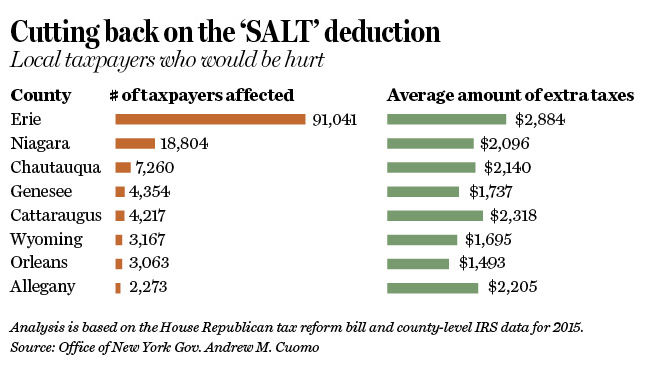

Salt Deduction Change Could Cost State Taxpayers 16 Billion Cuomo Says Local News Buffalonews Com

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Salt Cap Revolt Led By N Y Democrats Snarls Biden Spending Plan Bloomberg

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)